The State of AI in Different Countries — An Overview

Some are concerned that regulating AI progress in one country will slow that country down, putting it at a disadvantage in a global AI arms race. Many proponents of AI regulation disagree; they have pushed back on the overall framework, pointed out serious drawbacks and limitations of racing, and argued that regulations do not have to slow progress down.

Another disagreement is about whether countries are in fact in a neck and neck arms race; some believe that the United States and its allies have a significant lead which would allow for regulation even if that does come at the cost of slowing down AI progress. [1]

This overview uses simple metrics and indicators to illustrate and discuss the state of frontier AI development in different countries — and relevant factors that shape how the picture might change.

Key points:

- The top AI labs and models today are based in the United States and the United Kingdom.

- Key breakthroughs in AI research have largely come from the United States and Canada.

- China leads on the number of scientific publications and AI patent filings, but these numbers are complicated and rankings could be misleading; controlling for quality shows a U.S. lead.

- The following factors suggest that the United States and its allies will retain an advantage going forward:

- The United States invests more in AI than any other state.

- The United States and Europe have more access to top AI talent.

- The semiconductor supply chain is dominated by the United States, Taiwan, South Korea, Japan, and the Netherlands. Moreover, the United States and allied countries have imposed significant export controls (and will likely continue introducing new controls) on semiconductors. These are already affecting Chinese companies’ access to the most advanced AI chips.

- Censorship and other political and economic factors might hinder AI progress in China — and have already gotten in the way of AI development.

- If the United States and allied countries institute regulations that slow down AI development, they might similarly slow down AI progress in China, as Chinese advances in AI seem to significantly rely on research published abroad.

Where frontier AI progress is happening right now

The top AI labs and models are based in the United States and the United Kingdom

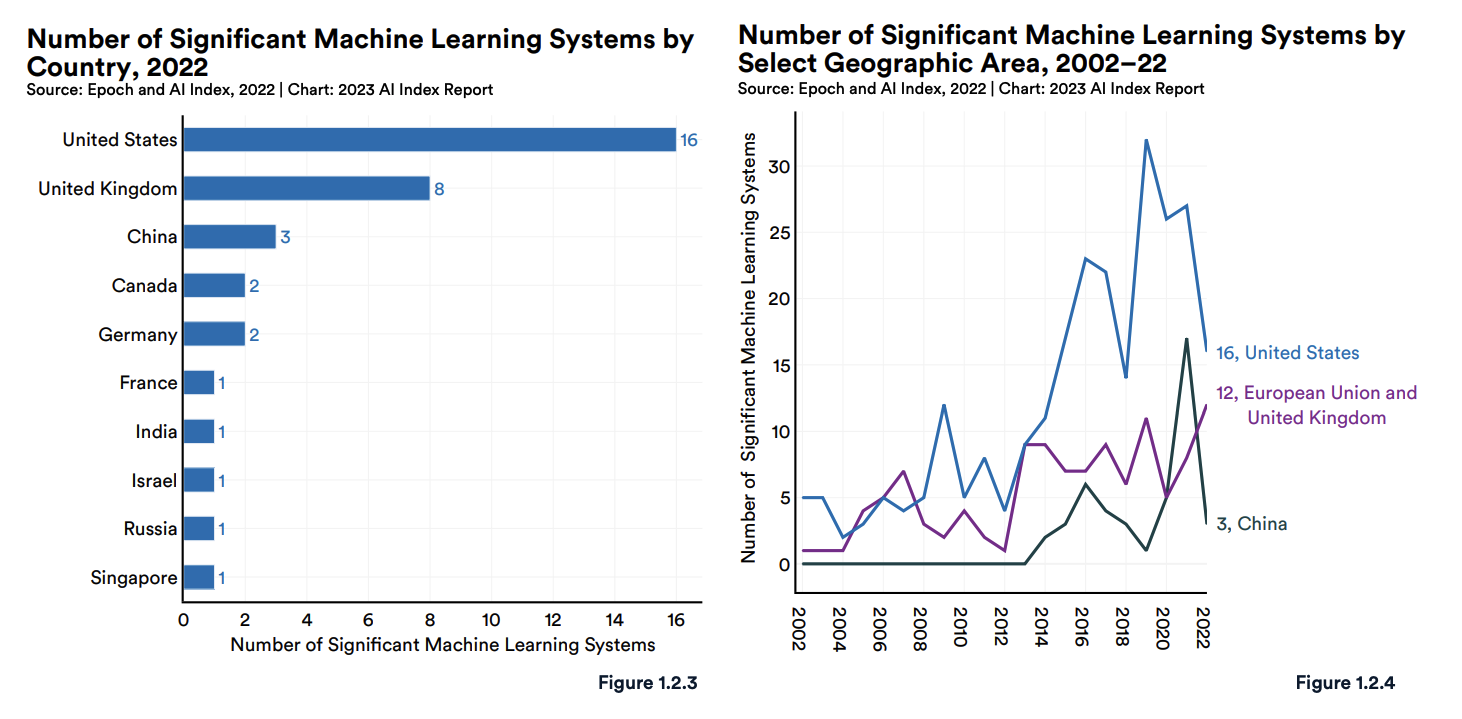

In terms of product performance and funding, the leading AI labs right now are arguably OpenAI (which produced ChatGPT and GPT-4), Google DeepMind, Anthropic, and Meta AI. [2] These are all U.S. companies or subsidiaries of U.S. companies. [3] If we widen the scope of “leading” to include all labs that produced machine learning (ML) models called “significant” in Stanford’s 2023 AI Index report, we still find that most of these labs are based in the United States. [4]

We can also measure national AI capabilities by comparing the number of important models produced in different countries. The 2023 AI Index reports that, according to their definition of “significant,” the United States stood out with 16 significant ML systems, followed by the United Kingdom with 8, China with 3, and then Canada, Germany, France, India, Russia, and Singapore.

Key breakthroughs in AI research have largely come from the United States and Canada

Since the “deep learning revolution,” deep learning has become the main paradigm in AI progress. Three of the scientists whose work contributed to this transformation (and who received a Turing Award for their work) — Bengio, Hinton, and LeCun — are based in Canada and the United States.

This reflects a broader pattern: key breakthroughs in modern AI research have happened primarily in the United States and Canada. This includes the development of AlexNet and deep convolutional networks (Canada), Generative Adversarial Nets (GANs) (Canada), reinforcement learning (U.S.), AlphaGo and deep reinforcement learning techniques (mainly developed in the United Kingdom and US), transformer architectures (U.S.), ResNet (U.S./China [5]), scaling laws (U.S.), GPT-1 & BERT (U.S.), unsupervised learning, reinforcement learning from human feedback (U.S.), etc. [6]

Focusing only on key breakthroughs that happened in 2022 (as selected by the AI Index Steering Committee), [7] we see that the trend continues: most come from the United States. Of the 22 breakthroughs listed, 5 arguably came from the United Kingdom, 1 from China, 3 from international collaborations, and the other 13 from the United States.

China leads on the number of scientific publications and AI patent filings, but these numbers are complicated and rankings could be misleading

Discussions about national capabilities in AI sometimes focus on the number of scientific publications relating to AI across different countries and patent filings — and the fact that China leads on these numbers. [8] But interpreting these numbers correctly is important.

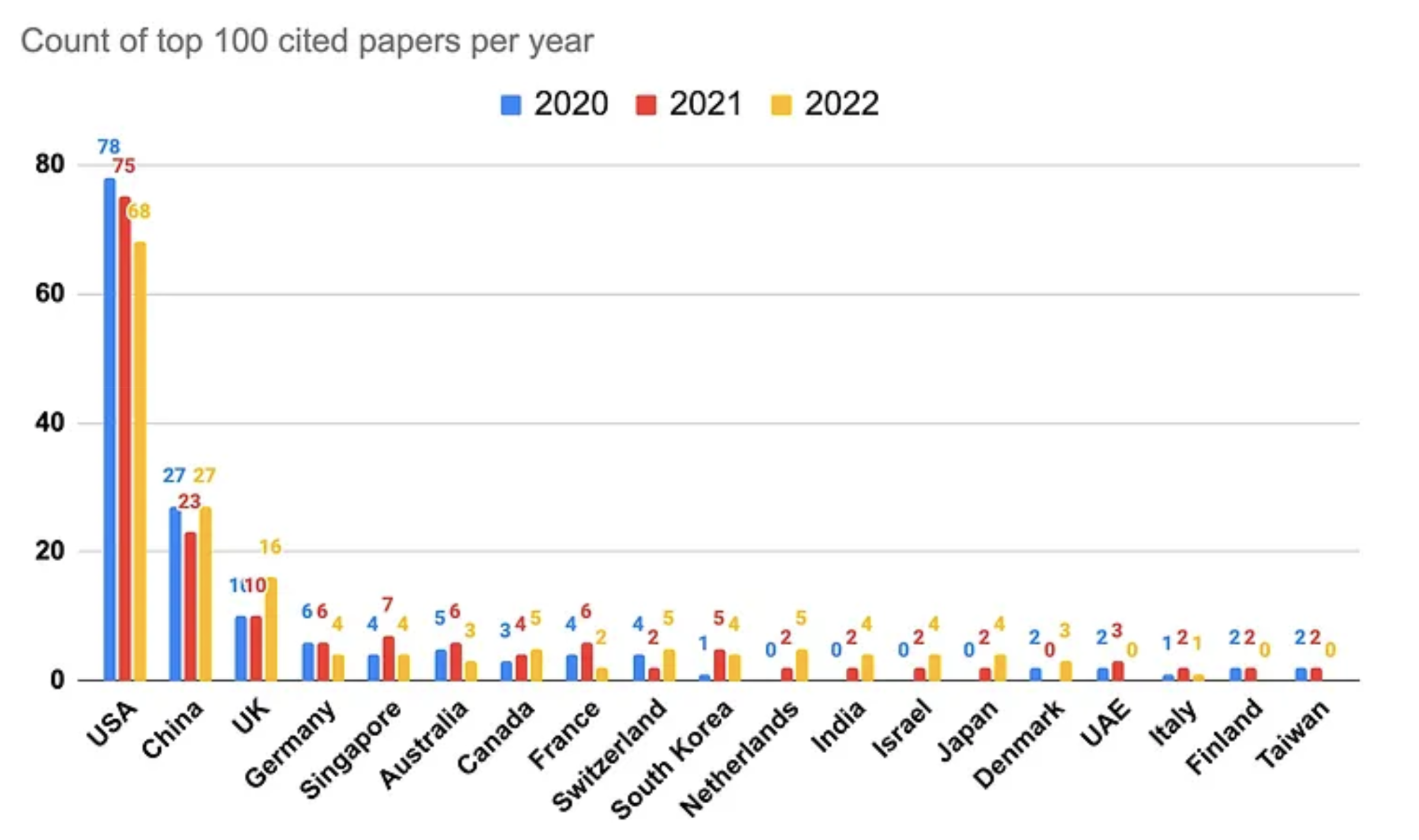

China produces more publications in total, but the United States produces most of the top publications. Chinese publications accounted for almost 40% of the total in 2019, while the United States’ share was around 20%. (Large financial incentives for Chinese academics might be a significant cause of this fact.) However, Chinese papers are cited less; the average number of yearly citations per article is 2.35 for China and 6.25 for the U.S. The U.S. lead on highly-cited research is most obvious at the very top: the United States dominates the list of the 100 most cited AI papers in 2022. [9]

Ultimately, it’s important to remember that the number of (top) publications produced by a group is a flawed measure of the progress that the group is making on advanced AI. Many of the most important advances in AI development come from industry rather than academia, and industry labs publish significantly less (and when they do, they more frequently publish pre-prints on arXiv). OpenAI illustrates this phenomenon well; they publish very few papers, but their models and papers are much more likely to be ground-breaking — almost 40% of OpenAI’s publications have made it into the list of the top 100 most cited publications in the past few years.

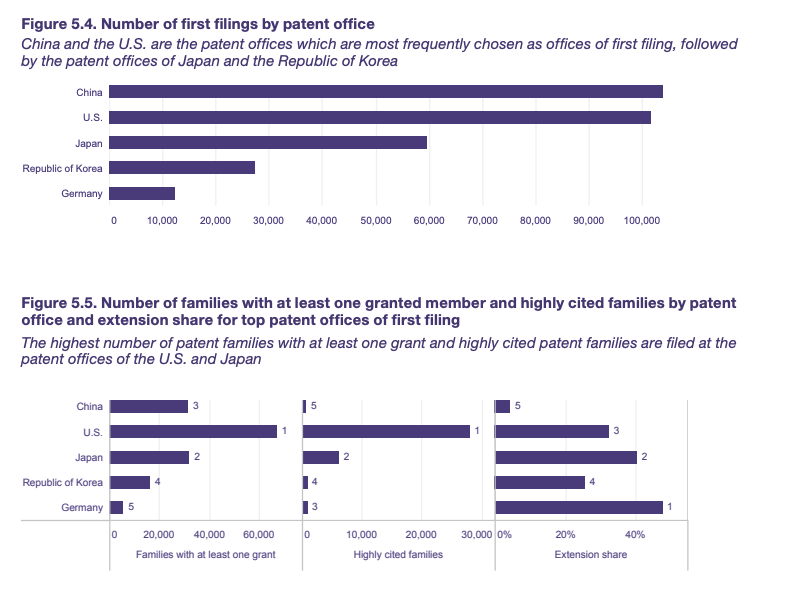

Patent filing numbers reflect patterns in publication numbers; more AI patents are filed in China than anywhere else, but this is also a complicated metric. In 2019, the World Intellectual Property Organization released a report showing that the number of new AI patents in China had surpassed the number in the United States. (As with academic publications, financial incentives for patent registrations might have led to this growth.) But the rankings look very different when metrics for patent quality are taken into account. Only 4% of the Chinese patents were subsequently filed in another jurisdiction, compared with 25% to 63% of the patents initially filed in other countries, suggesting that the patents are less important on average — when an invention looks especially promising, applicants often file further patents in other jurisdictions. [10] The number of other patents citing an older patent can also be a measure of quality. The United States ranked first for the number of highly cited patent applications, while China ranked fifth: behind Japan, Germany, and South Korea. [11]

Countries also have different advantages in different areas, and this complicates the picture. In a 2019 testimony, Professor Jeffrey Ding points out that the United States significantly outperforms China when it comes to developing key platforms and support architectures that power many AI projects. According to a Chinese government white paper cited in the testimony, 66% of the world’s AI open-source software (like the ML framework PyTorch) was developed mainly by U.S. developers, compared to the 12% that was developed by Chinese developers. Most assessments of national AI capabilities inflate China’s performance by focusing on technological development and specific applications, like new products (e.g. smart speakers) and startups.

How all of this might change in the future

The top labs of today (or of 2022) might not stay the top labs forever, so it is helpful to examine how AI progress in different countries will change in the future. There are many different approaches to this question. Tortoise Media’s Global AI Index scores nations on their levels of investment, innovation, and implementation of AI (in its 2023 report, the U.S. ranked first on all three dimensions, followed by China, Singapore, the United Kingdom, and Canada, which ranked better and worse on different factors). Other analysts focus on national investments in AI development, or on different states’ announced plans to speed up AI progress — a lot of media coverage has focused on China’s well-publicized goals and government partnerships with labs. Other researchers build models that look at factors like the availability of computing resources and training data, the state of technological and intellectual progress in different nations, and what other factors might affect the development and release of powerful AI models.

These approaches and the people taking them have many disagreements, but it seems that the United States has an advantage in terms of access to key resources needed for frontier AI development (funding, top AI talent, the semiconductor supply chain), and China has some specific political and economic qualities that might hinder AI development.

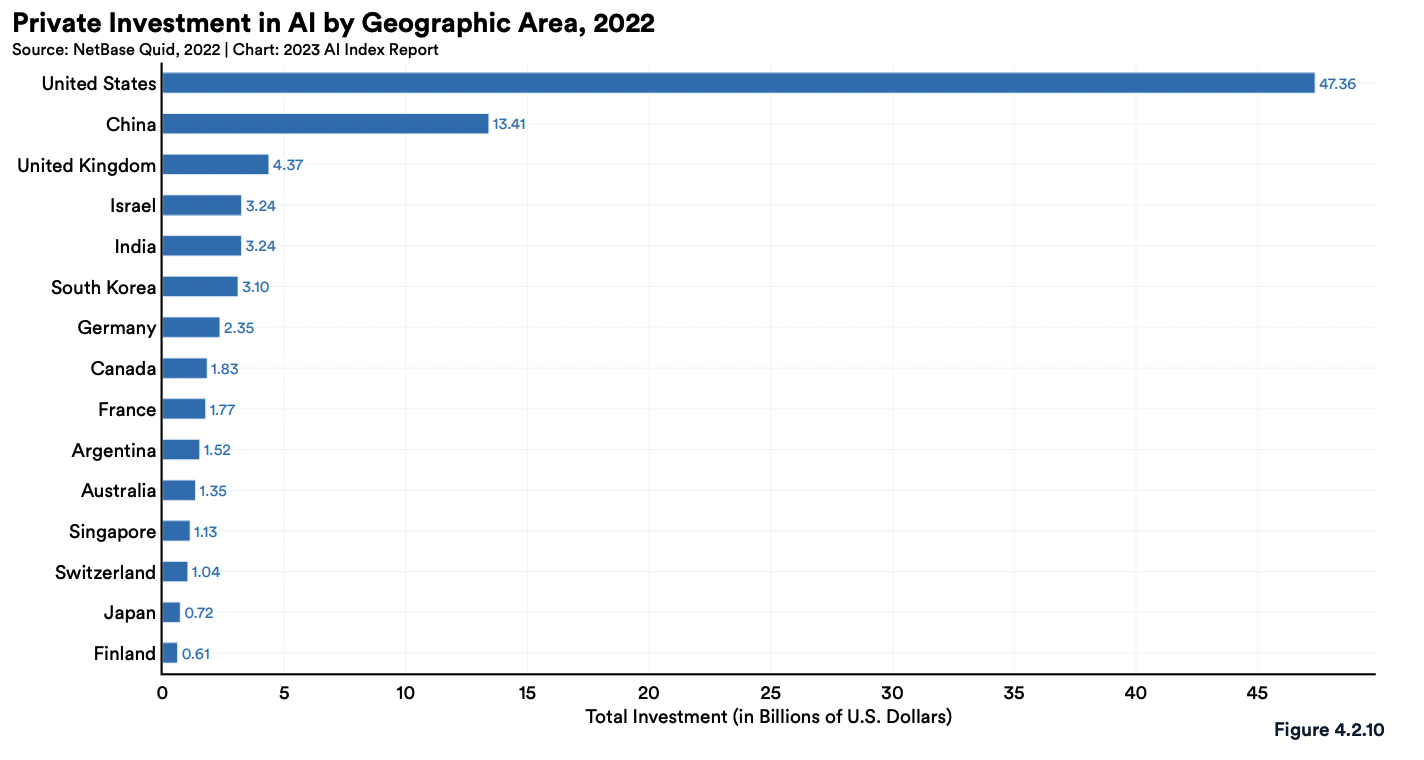

The United States invests more in AI than any other state

The United States invests more in AI development than any other state. As described in the 2023 AI Index Report: “In 2022, the $47.4 billion invested in the U.S. was roughly 3.5 times the amount invested in the next highest country, China ($13.4 billion). [12] The U.S. also continues to lead in terms of total number of newly funded AI companies, seeing 1.9 times more than the European Union and the United Kingdom combined, and 3.4 times more than China.”

Some countries also have national strategies and dedicated budgets for steering the development of AI, but the dedicated budgets are much smaller than total private investments. The U.S. government, for instance, allocated $1.7 billion to AI R&D in 2022 (and requested $1.8 billion for 2023). China has announced plans to become a leader in AI innovation, but China’s public investment data is not very transparent and getting exact investment numbers can be difficult. A 2019 report from the Center for Security and Emerging Technology (CSET) estimates that public AI R&D investment was on the order of a few billion dollars in 2018 (the 2023 AI Index shows that U.S. spending was $1.29 billion in 2018), while total private investment globally was around $80 billion in 2018. The report also notes that government spending probably tilts toward applied research and experimental development, not basic research — supporting patterns noted earlier.

The United States and Europe have more access to top AI talent

“Human talent might be the most valuable input into a nation’s AI ecosystem,” according to Professor Ding’s testimony. The United States seems to lead in terms of access to top AI talent.

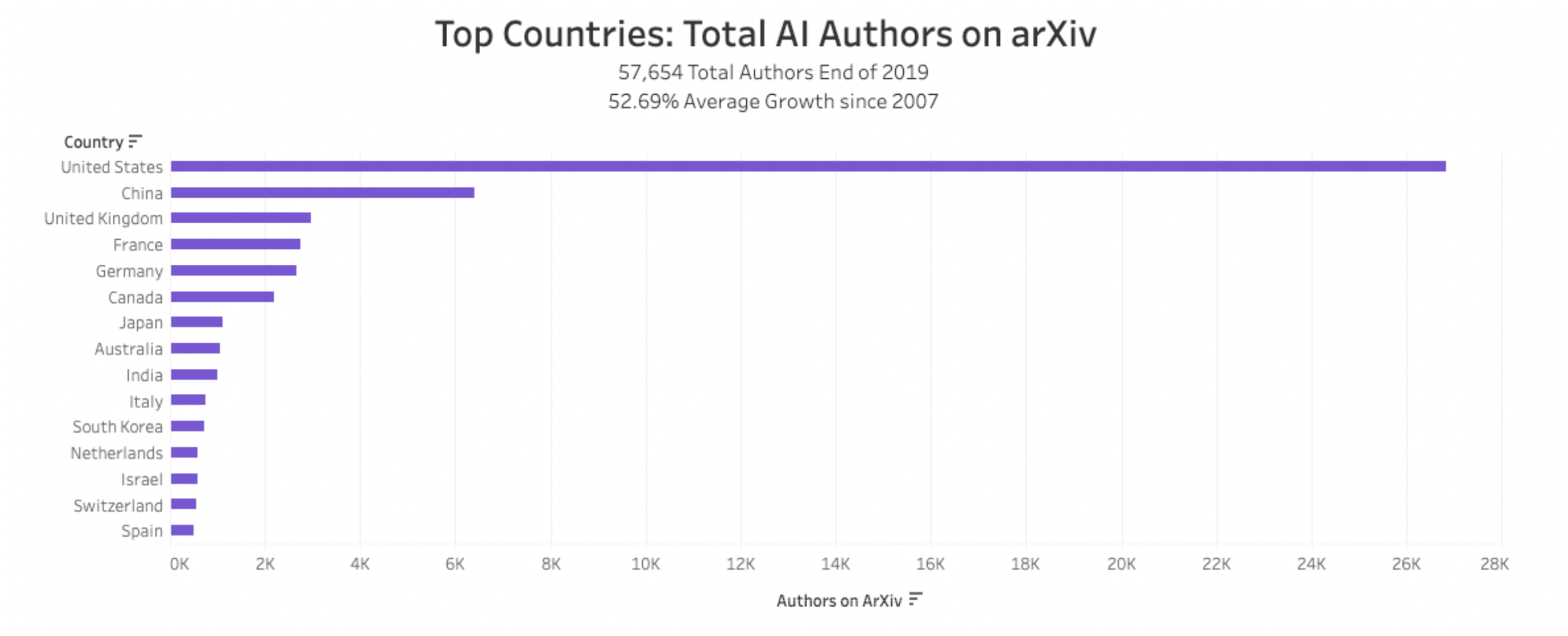

A report on global AI talent in 2020 studied repositories on arXiv (where researchers pre-publish papers) to estimate metrics about global AI talent. It’s important to note that China is likely underrepresented in these numbers because publications in non-Latin alphabets more rarely get posted to arXiv. According to the report, U.S. authors account for almost half of all AI authors on arXiv (47.9%). China is in second place, with 11.4% of the global share.

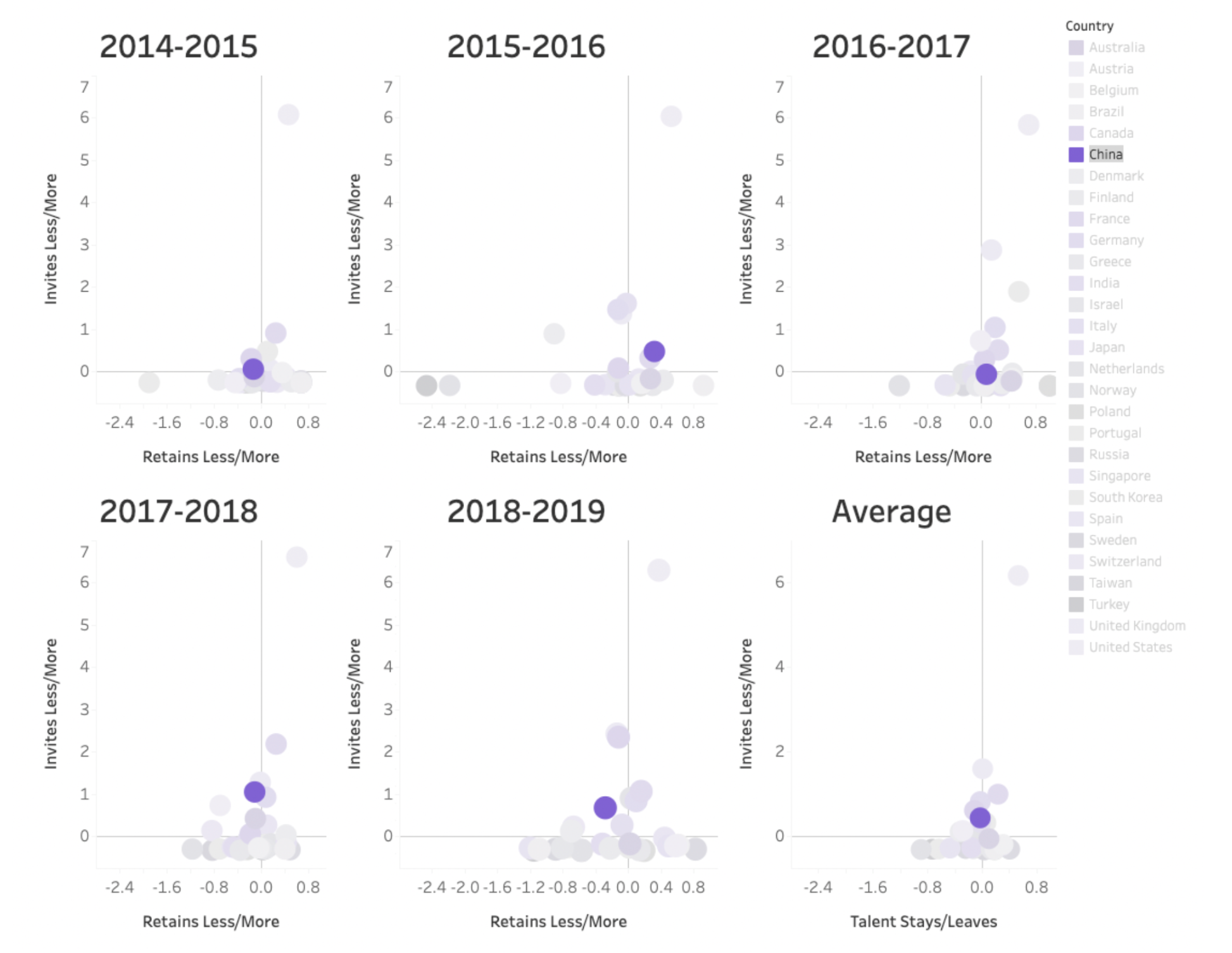

The report also studied the extent to which different countries attract foreign AI talent and retain domestic AI talent. It seems that China (the highlighted datapoint in the charts below) is about average (it retains talent slightly less and invites talent a bit more), while the United States (the datapoint highest on the Y axis in the charts below) is an outlier [13], especially for attracting foreign talent:

China’s Ministry of Industry and Information Technology published a report in 2020, translated into English by researchers at the Center for Security and Emerging Technology (CSET) [14]. The report describes a talent shortage in China, noting that universities are struggling to build the quality and capacity necessary to supply enough qualified applicants demanded by the industry side, and that demand for new graduates is significantly lower than demand for more experienced AI practitioners (around 3% of the overall demand in 2019 was for new graduates, who comprised around 14% of AI job-seekers). [15]

The semiconductor supply chain is dominated by the United States, Taiwan, South Korea, Japan, and the Netherlands — and export controls will likely limit Chinese companies’ access to advanced semiconductors

Machine learning relies on computing power, algorithms (research and scientific progress), and data for training models. It’s not clear that any regions have an advantage in data. Some (including China’s Ministry of Industry and Information Technology) have argued that China has an advantage due to the large amount of user data accessible to key companies in China, but powerful large language models are currently mostly trained on large corpuses of publicly accessible content. [16]

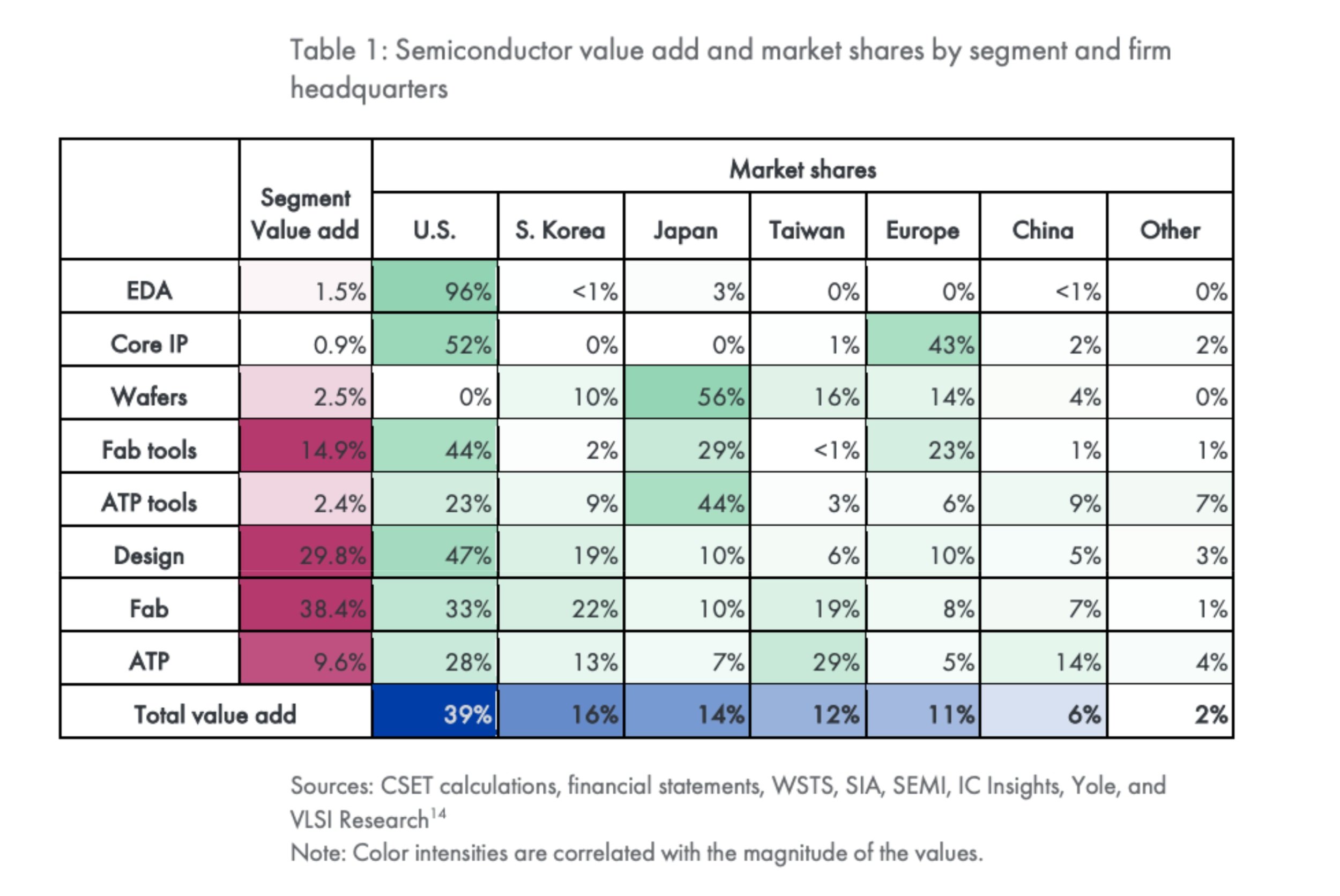

Regions vary significantly in terms of control over the semiconductor supply chain (and therefore future access to computing power), on the other hand. Only three companies can currently produce the most advanced chips (semiconductors), and all are based in the United States or allied countries: TSMC (Taiwan), Samsung (South Korea), and Intel (United States). Manufacturing these chips, in turn, relies on three broader processes: design, fabrication, and “ATP” — assembly, testing, and packaging. And production requires technologically complex equipment, materials like highly pure silicon and xenon gas, and intellectual property related to the chip designs (which can involve billions of interconnected components).

As described in a CSET brief, semiconductor manufacturing is currently dominated by the United States and its allies; Japan, South Korea, Taiwan, and Europe. In brief, advanced chip design and development (mostly by AMD and Nvidia), as well as the software for that design, is based in the United States. [17] The US, South Korea, Europe, Japan, Taiwan, and China lead on the production of semiconductors, but key steps are dominated by specific countries and groups. Critically, the US, Japan, and the Netherlands dominate the production of semiconductor manufacturing equipment, which includes tools for tasks like wafer manufacturing and marking, ion implantation, lithography, etc. [18] These are key chokepoints for China. Taiwan Semiconductor Manufacturing Company (TSMC) is responsible for over 90% of manufacturing of the most advanced chips; South Korea makes the rest. ASML (based in the Netherlands) is the only company that makes the machinery needed for this process. And Japan controls photolithography, which draws circuit patterns on layers of silicon used in a chip.

Moreover, recent (and expanding) export controls will make it much harder for China to catch up. An analysis for the Center for Strategic & International Studies (CSIS) explains that late 2022 controls passed by the U.S. government will “strangle” Chinese semiconductor industry, specifically targeting the production of chips designed to be linked together for large AI models. The controls limit Chinese groups’ ability to buy high-end AI chips, remove access to key chip design software (which is almost entirely designed in the United States), prohibit sales of U.S.-built semiconductor manufacturing equipment (Chinese alternatives are estimated to be more than a decade and a half behind the U.S. state of the art), and control other important components. (The controls affect all companies operating in China in part because the Chinese military sometimes uses shell companies to buy products companies are not allowed to sell directly to the military.) Other governments are also adopting controls — most notably the Dutch and Japanese governments, which have already announced export controls on advanced semiconductor manufacturing equipment (those two countries, together with the United States, account for 90% of global sales of such equipment). The effects of these controls compound existing economies of scale and network effects; new products have to be compatible with other parts of the supply chain and with older chips (see CUDA), and need to work with a tight network of established firms, making it harder for any new companies or groups to start a profitable business in this area.

China leads on assembly, testing, and packaging (ATP). This is important and labor-intensive, but is less technically complicated. (Packaging might become more of a bottleneck on chip performance in the future.) Japan, Singapore, the US, and some other countries are also involved. And China has the largest share for many raw materials required for chip manufacturing, but faces chokepoints in the production of manufactured materials (300 mm wafers, photomasks, and photoresists), which are primarily produced by Japan, the US, Taiwan, South Korea, and Germany. (The U.S. and its allies also produce a sizable share of all raw materials except for three.)

Censorship and other political and economic factors might hinder AI progress in China

China’s unusual political and economic environment might significantly affect Chinese AI development.

Censorship will have a significant impact on the viability of most generative AI products in China. China’s ruling Communist Party censors public discourse in China. Citizens cannot access sites like Google and Facebook, and some topics and political stances are strictly forbidden. Large language models cannot be trained on datasets that include forbidden discourse (which is important because limiting data harms performance), and if an AI product like a chatbot (like ChatGPT) outputs responses critical of the Chinese government or similar, it could be suspended [19], and companies are liable if their AI products share content that violates censorship laws. But controlling what responses models like this output is notoriously difficult, and might directly trade off with quality. [20] As a result of this censorship, developing powerful, user-facing language models in China is more difficult and less commercially viable. (The practice has already led to the removal of many Apple Store apps in China.)

China might have lower capacity to “diffuse” or spread technological innovations through its industries, which might significantly hamper its ability to leverage AI progress. Innovations typically need to be adopted and built on to have an impact. A state that produces a technological breakthrough might have an advantage and be able to adopt or “diffuse” new technologies quickly, but winning the “race” is not guaranteed; another country might still adopt the innovation first if its enterprises are better connected to research institutes. [21] A recent paper in the Review of International Political Economy discusses important historical examples, [22] argues that diffusion is underemphasized in most assessments of countries’ scientific and technological capabilities (which often focus on countries’ ability for innovation), and claims that China has particularly low diffusion capacity — meaning that assessments generally overestimate China’s potential for scientific and technological leadership. For instance, when indicators for countries’ technological powers are separated into innovation and diffusion indicators, evaluating China on diffusion capacity in 2020 means that China’s average ranking drops by 34 spots, putting it close to the Russian Federation — which ranks 47th overall. Its slow adoption of information and communications technologies like cloud computing is likely both a symptom and a cause of diffusion issues.

Slowing down AI development in a leading country would probably also slow down development in other countries (particularly China)

A lot of AI research is international and published research is accessible to (and often used by) AI developers in other countries; AI progress in one country speeds up progress in others. Additionally, some evidence suggests that AI progress in China is especially reliant on AI progress elsewhere. If this is true, slowing AI progress in countries like the United States [23] would also slow down progress in China.

In one article, researchers argued that “AI advances in China rely a great deal on reproducing and tweaking research published abroad, a dependence that could make it hard for Chinese companies to assume a leading role in the field. If the pace of innovation slackened elsewhere, China’s efforts to build LLMs—like a slower cyclist coasting in the leaders’ slipstream—would likely decelerate.” They pointed out that on one occasion in 2021, over 100 researchers at Stanford collaborated on a major paper about “foundation models.” Half a year later, “the Beijing Academy of AI released a similarly lengthy literature review on a related subject, with almost as many co-authors. But within a few weeks, a researcher at Google discovered that large sections of the Chinese paper had been plagiarized from a handful of international papers—perhaps, Chinese-language media speculated, because the graduate students involved in drafting the paper faced extreme pressure and were up against very short deadlines.”

Moreover, concerns that if one country regulates AI, it will be at a disadvantage compared to others seem oversimplified, if only because many governments are beginning to regulate AI. According to the AI Index, at least 31 countries have passed an AI-related bill since 2016. China has introduced extensive regulations. And many countries are actively looking to follow the lead of the United States, the United Kingdom, and the European Union on whether and how to regulate use and misuse.

Concluding notes

This overview simplifies the picture (it mixes many different kinds of AI research together, ignores important economic forecasts, barely mentions important countries like India and Israel, etc.), ignores infosecurity factors (espionage might reduce the gap between leading and lagging countries), and might be missing key considerations, but many factors seem to point to an advantage for the United States and its allies. Additionally, it is true that a lot of important AI progress is happening in China, but many assessments of national AI capabilities seem to inflate China’s importance.

And it should be noted that, while the overview focuses on “progress” and which countries lead on AI development, it does not assume that AI development will always benefit the country it originates in more than it benefits other countries or at all — in fact, careless AI development might be catastrophic.

Footnotes

Regulation does not have to slow down development. For instance, thoughtful regulation could prevent future issues that would lead to drastic and reactive regulations that significantly inhibit an industry’s progress (nuclear reactors could be considered an example here).

“Leading lab” is a vague notion; some labs might have a lot of funding but a weak output, while others might publish a lot but never produce a significant model or a piece of research that’s important enough to be cited by other groups. Besides funding, we could look at a list of 100 most cited papers in 2022 and identify the groups whose work was cited the most. Google/DeepMind, Meta, Microsoft, UC Berkeley, Stanford, the University of Washington, Carnegie Mellon University, OpenAI, MIT, Tsinghua University, NVIDIA, National University of Singapore, New York University, Cornell University, and Princeton University all contributed papers in this list. Almost all of these are US-based.

Google Deepmind is headquartered in the UK but is a subsidiary of the US-based Google.

Epoch’s data produces the following organizations (there might be errors in data labeling):

- University of Washington – USA

- Tsinghua – China

- Stability AI – UK

- OpenAI – USA

- NVIDIA – USA

- Naver Corp – South Korea

- Microsoft – USA

- Meta AI – USA

- Hugging Face – USA

- Huawei – China

- Google – USA

- EleutherAI – USA

- DeepMind – USA/UK

- Baidu – China

- BAAI – China

- AI21 Labs – Israel

- Runway – USA

- Big Science – USA

This was from Microsoft Research Asia.

Countries are based on institutional affiliations. E.g. GANs were developed by Goodfellow, an American working in Canada. We count them as originating in Canada.

The list included breakthroughs from international collaborations (3), DeepMind/Google (7), Meta (4), OpenAI (3), Nvidia (1), Tsinghua (1), Stanford (1), GitHub (1), and Stability AI (1). The breakthroughs chosen were:

- AlphaCode – DeepMind – UK

- RL agent that can control nuclear fusion plasma in a tokamak – DeepMind – UK

- IndicNLG benchmarking datasets – international collaboration

- Make-A-Scene – Meta – US

- PaLM – Google AI – US

- DALL-E 2 – OpenAI – US

- Gato – DeepMind – UK

- Imagen – Google Research – US

- BIG-bench – international collaboration (132 institutions)

- Copilot available for developers – GitHub – US

- Better-performing GPUs – Nvidia – US

- No Language Left Behind – Meta – US

- GLM-120B – Tsinghua – China

- Stable Diffusion – Stability AI – UK

- Whisper – OpenAI – US

- Make-A-Video – Meta – US

- AlphaTensor – DeepMind – UK

- Improved reasoning for PaLM – Google – US

- BLOOM – international collaboration

- HELM – Stanford – US

- CICERO – Meta – US

- ChatGPT – OpenAI – US

From 2010 to 2021, China has produced almost 40% of all publications in AI journals and 22% of all publications at AI conferences. The figures for the US are 10% and 24%. (See more in the AI Index report.)

A 2022 data brief for the Center for Security and Emerging Technology (CSET) analyzes the top 5% of AI publications (in all sub-domains of AI) by citation number and concludes that Chinese researchers are publishing a growing share of the most cited research, reaching parity with the U.S. in 2019 (the U.S. and China combined publish about 65% of highly cited AI research. (U.S. allies, particularly the European Union and the Five Eyes countries, also make significant contributions to AI research.) This varies based on the sub-domain of AI research. For instance, China is more prolific in computer vision, while the United States publishes a greater share of the top research in natural language processing. See figure 4 in the data brief for an illustration.

This is one measure of quality, but the findings might be partly due to the fact that Chinese patent applicants are more interested in the domestic market.

One reason for this could be regional subsidy programs for patents, which were introduced in the late 1990s to promote innovation. According to an analysis published in the China Economic Review in 2015, these programs encourage people to file low-quality patent applications, increasing the overall counts in China by more than 30%.

These figures are in nominal exchange rates, not purchasing power parity (PPP). Switching to PPP would slightly reduce reduce the U.S. lead, but not by much. A counter-consideration to keep in mind is that this difference doesn’t matter for GPU hours, and GPUs are a key bottleneck for AI development. You also can’t buy some of the most exclusive inputs in China at all (like the very best talent and the very best chips).

Only about 10% of international scientists and engineers seem open to moving to China, compared to nearly 60% for the US, according to an analysis from the Center for Strategic and International Studies, which highlights immigration as a key strength of the US. In two surveys of STEM and AI researchers in 2012 and 2019.

Among other things, it emphasizes areas of talent shortage, noting that this is especially noticeable in “basic” research areas like AI chips and cloud computing, where the number of AI practitioners is about 14 times smaller than the number in the US. “…the total number of AI talents in China is only about 50% of the total number of talents in the United States, and the number of talents engaged in basic research work is even more limited. The current number of basic layer AI practitioners in the United States is about 14 times that in China.” There are also imbalances in where new talent is going: “While application development positions represent 19.8% of enterprise demand for job positions, 30.4% of talents lean toward this type of position when choosing their career. For tech support positions, however, which account for 34.8% of the overall job demand, only 12.5% of the talents intend to enter positions of this type.”

The report also noted that among AI researchers publishing at the 21 leading academic conferences in 2018, more earned their Ph.D. in the US (44%) than in the EU (around 21%) and in China (11%) combined. Moreover, among the 20 companies with the most AI talent according to AI paper and patent records in 2017, half were based in the US, which accounted for 1623 AI workers. The EU had 6 companies totaling 522 workers, and the only Chinese company ranking in the top 20 was Huawei with 73 workers.

The Center for Data Innovation compiled metrics on the United States, China, and the EU, and found a significant lead for the EU and the US (especially among top researchers) in the number of all AI researchers in 2017/2018.

Moreover, it’s important to remember that large language models are trained on public datasets, where English is particularly well represented. (Explore this website for data about languages, and this overview of the challenges for “low resource languages”.)

Importantly, chip design is incredibly complex (and is produced in the US), and requires specialized design software, which is also almost entirely produced by US-based companies.

The US is the dominant producer of electronic design automation software (95/5% of shares in 2019), and the US and the UK are dominant producers of core intellectual property for chip designs (together accounting for 95.4% of global shares in 2019).

The US dominates R&D spending at $39.8 billion in 2019, with total global spending amounting to $64.6 billion in 2018.

Japan, the US, Germany, and Austria are key for wafers. The US is dominant for ion implanters. The Netherlands and Japan are dominant producers of lithography equipment (China cannot produce any advanced lithography equipment). The US and Japan are the main producers of etch and clean equipment (South Korea and China are also significant). The US and Japan are dominant for chemical mechanical planarization tools. https://cset.georgetown.edu/wp-content/uploads/The-Semiconductor-Supply-Chain-Issue-Brief.pdf

This isn’t a theoretical concern: ChatYuan, a Chinese generative AI similar to ChatGPT, was suspended by authorities in February 2023.

In an article in Foreign Affairs, researchers note that Baidu’s Ernie Bot gives “canned answers to questions about Xi and refuses to respond other politically charged topics.”

“Per one estimate derived from data on the OECD countries over 135 years, 93 percent of total factor productivity increases in these high-income countries comes from knowledge that originated abroad (Madsen, 2007).”

The Soviet Union from 1950 to 1970 is an example of a state that was strong on innovation (it launched the first satellite, was spending more on R&D as a percentage of its GDP than any other nation, and had twice as many science PhD graduates as the US), but was behind on diffusion (industries were slow to adopt important breakthroughs, potentially due to a separation between the R&D system and the broader economy and poor incentive systems).

or publishing less about frontier AI methods